Menlo Students Learn to Invest Through Investment Club’s Stock Market Competition

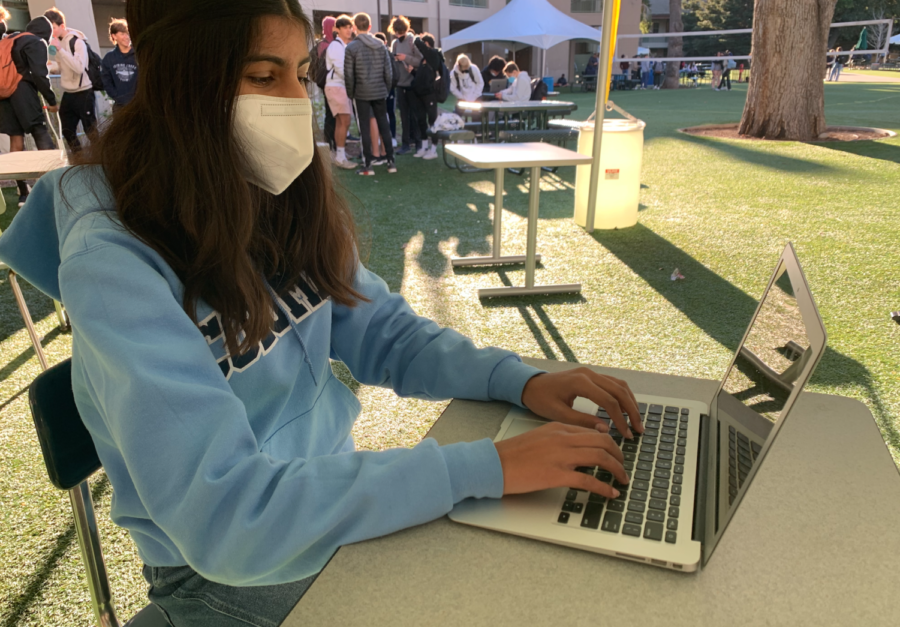

Freshman Navya Nandani checks her stocks on MarketWatch. Staff photo: Rhea Nandal.

March 3, 2022

Menlo’s investment club launched an investment competition on the stock market simulator MarketWatch. Each player starts with $100,000 of fake money and uses it to invest. To this date, the competition has 78 members. The top three contestants with the most money by April 1, 2022, will win prizes provided by the investment club. “First place gets a money gun [that shoots] like $10,000 of fake money. Second place gets a Jordan Belfort bobblehead, and third place gets a book called ‘Freakonomics,’” club co-leader Vikram Sheshadri said.

Sheshadri, along with co-leaders Daniel Solomon, Saaz Ahuja and Ben Tsuda started the competition this year. Math teacher Rebecca Akers is the teacher advisor for the club. “I am really just a figurehead advisor,” Akers said.

In previous years, the club has been small, with only a few members. This year, the club had around 70 initial sign-ups at the club fair, so the leaders decided to start a competition for members to do on the side. “It’s pretty cool to see some kids really getting into investing. I didn’t know that there was such a big investment culture at Menlo,” Sheshadri said.

During meetings, club leaders give presentations on current financial events or information on investing. However, Sheshadri believes that the stock market simulation is the most efficient way to get experience. “The best way to learn about investing is by doing it,” Sheshadri said.

One of the most unique aspects of the stock market simulation is that it uses fake money. According to Seshadri, this gives players an opportunity to build up investor confidence. Sophomore Nathan Chan, who is first on the leaderboard with over $2.5 million in profit, has had experience losing money to investments in the past. He’s participating in the game for more low-stakes practice. “I don’t have a sense of how [the game] will connect to my real life. Like, if I lose [some] amount of money in the game, that’s not gonna translate to my life at all,” Chan said.

Sheshadri considers himself to be a safe investor and claims that he can go through failures more easily with fake money. “Having a virtual stock market game is kind of a good way to test your limits,” Sheshadri said. “You can see how many risks you want to take, whether those risks often work out for you or not.”

Freshman Navya Nandani had the same mindset going into it. “I joined the competition because I wanted [to know] how to invest money wisely,” Nandani said.

Many people involved in the game believe that investing is an important skill to learn. “Just knowing the basics is really important because most adults are going to be investing one way or another at some point in their lifetime,” Chan said. Nandani shared the same idea. “Investing is becoming more popular nowadays, and I want to have early exposure to it,” Nandani said.

Math teacher Randy Joss, who was a bank consultant for seven years at various different banks, agreed. He argued that if you keep all of your money in a savings account and don’t invest it, then the inflation rate will be higher than the interest rate and you will lose money. If you invest it, then you could either lose money, or you could gain money. “If you were deciding where to put your money between someplace where you would definitely lose money or someplace you might lose money, you’re going to choose the place where you might lose money,” Joss said. According to Joss, kids should get early exposure to financing so they don’t lose money later on.

Chan has been investing for four years. He started with the help of his dad and is grateful that he has had more time to grow as an investor. “I can make better investments now and not make the same mistakes I made four years ago,” Chan said.

Sheshadri, who likes to invest on the side, doesn’t view investing as a main career choice for him but still agrees that learning how to invest is important. “Even if it’s not the main career you’re pursuing, it’s a great way to make some passive income. And, just in general, finance kind of ties into every aspect of your life. Whatever job you’re doing, you need to know how to manage your finances,” Sheshadri said.